Are Hong Kong banks quietly fuelling the decline of our older residential neighbourhoods?

By HK Lawyer AJ Halkes Barrister-at-Law

When homeowners downsize or sell, they often accept lower prices, wanting to move quickly. The same applies to those upgrading.

But banks often benchmark entire buildings against isolated low transactions, dragging down valuations for an area. This reduces borrowing power for potential buyers, pushes prices down further, creating a vicious cycle. The decline in demand and the reduced ability to buy is being driven by the banks themselves.

Meanwhile, new developments benefit from high loan-to-value ratios and generous valuations, keeping prices for them inflated and entry difficult for first-time buyers.

Eager buyers can’t get on the ladder due to low valuations or high prices, and existing homeowners face the same financing roadblocks. They can’t sell at a price that buyers can actually finance.

The banking sector’s approach to Hong Kong’s secondary property market seems tilted only toward new projects. By prioritising loans on fresh developments, banks push older districts into further decline instead of supporting urban regeneration.

Eventually, these ageing neighbourhoods fall into developers’ hands. Banks, of course, then finance their redevelopment into high-rise towers with little character.

Loan terms for older blocks have been cut sharply, sometimes now to just a few years. Even well-maintained older properties with good layouts are made out of reach for professionals with solid incomes.

Take a typical walk-up in Happy Valley. It should be a decent prospect, yet low valuations and short loan periods (tied to building age) make it nearly impossible to buy except for cash. The system the banks run does seem to operate to deliver older properties straight to developers, ensuring yet more urban decay.

Imagine if younger people could buy these older homes, renovate them, and bring new energy into these neighbourhoods. It would create vibrant communities with homeownership more attainable.

If the government encouraged banks to restructure financing for older buildings, it might disrupt the relationship between banks and developers. But the benefits would be huge: via more accessible housing, revitalised local economies, thriving ground-floor retail, and stronger community connections.

We could breathe life back into Hong Kong’s older districts, reduce urban decay, and make our city more dynamic and liveable.

Isn’t that the kind of long-term vision and community regeneration our banking sector should be proud to support?

If you need specific input regarding a strategic Hong Kong challenge or related legal matters in the HKSAR you can always DM me and check out my profile at https://www.ajhalkes.com

hashtag#HongKongProperty hashtag#UrbanRegeneration hashtag#BankingStrategy hashtag#HKRealEstate hashtag#CommunityRevival hashtag#HousingCrisis hashtag#PropertyFinance hashtag#CityDevelopment hashtag#AffordableHousing hashtag#HongKongBusiness

The government has imposed standards on protective netting around occupied residential properties By HK Lawyer AJ Halkes Barrister-at-Law The government has imposed standards on protective netting around occupied residential properties,...Read More

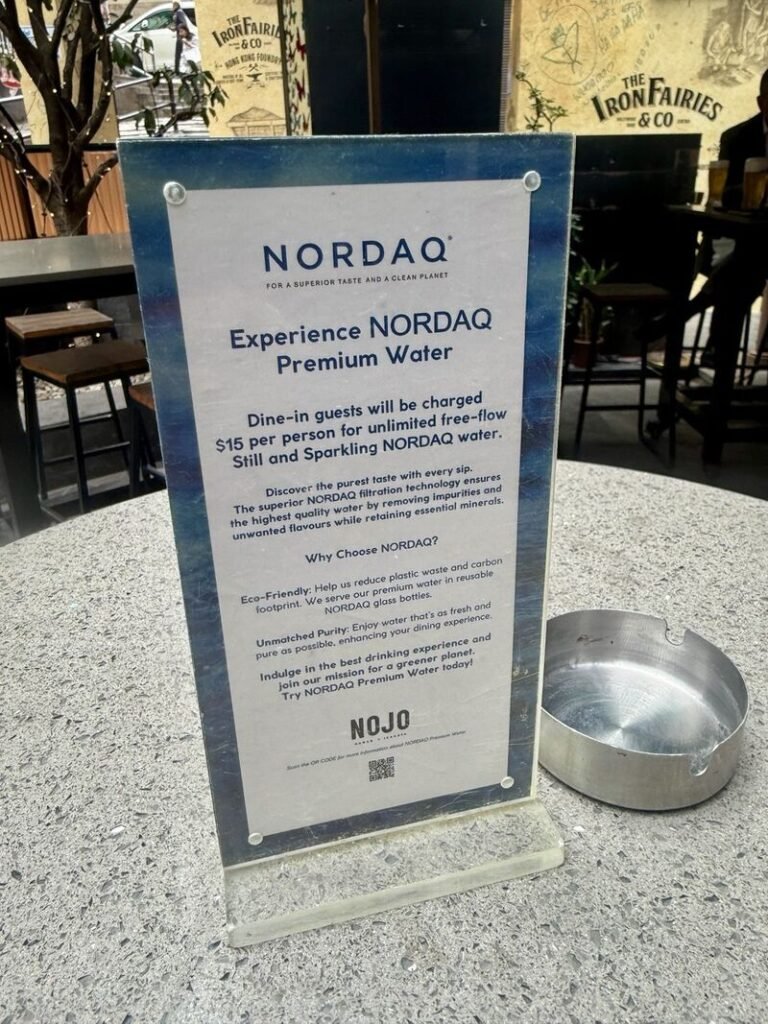

When water is basically free and all F&B outlets have a filtration system – why charge? By HK Lawyer AJ Halkes Barrister-at-Law When water is basically free, and all F&B...Read More

Suffering long term COVID effects is very real for some businesses By HK Lawyer AJ Halkes Barrister-at-Law Suffering long-term COVID effects is very real for some businesses. Even though the...Read More

Hire the right influencers, create the right buzz, now you can sell almost anything! By HK Lawyer AJ Halkes Barrister-at-Law I wrote about this place opening on a site that,...Read More

So Hong Kong is lucky, here comes Luckin Coffee By HK Lawyer AJ Halkes Barrister-at-Law So Hong Kong is lucky, here comes Luckin Coffee. Will they be all over the...Read More

Not near the mid-levels HK escalator, you’ll struggle running a business in HK (SoHo) By HK Lawyer AJ Halkes Barrister-at-Law If you’re not near the mid-levels Hong Kong escalator, you’ll...Read More

Adrian Halkes appointed to the eBRAM Panel of Mediators! By HK Lawyer AJ Halkes Barrister-at-Law Happy to share my appointment to the eBRAM Panel of Mediators, using its innovative, tech-driven...Read More

Geronimo in Lan Kwai Fong is closing By HK Lawyer AJ Halkes Barrister-at-Law Geronimo in Lan Kwai Fong is closing; a 13-year ago leap of faith and courage, when my...Read More

Hong Kong has many quirky food and coffee spots for tourists and locals By HK Lawyer AJ Halkes Barrister-at-Law Hong Kong has many quirky spots for tourists and locals. Upper...Read More

Early bird gets the bun at the Sing Fat bakery in Kam Tin By HK Lawyer AJ Halkes Barrister-at-Law EARLY BIRD GETS THE BUN at the Sing Fat Bakery in...Read More

Is now the best time in decades for Hong Kong F&B operators to buy their own premises? By HK Lawyer AJ Halkes Barrister-at-Law Is now the best time in decades...Read More

Bad reviews do not mean bad business By HK Lawyer AJ Halkes Barrister-at-Law Bad reviews do not mean bad business. Don’t let perfect be the enemy of good food and...Read More

AI already is “way better” than junior human lawyers in many areas By HK Lawyer AJ Halkes Barrister-at-Law This is the harsh truth: “You have law firms that are currently...Read More

Privacy matters a lot if you run bars, restaurants, fitness venues, shops and clubs. By HK Lawyer AJ Halkes Barrister-at-Law Privacy matters a lot if you run bars, restaurants, fitness...Read More

Once in a decade Jiao Festival organised by the indigenous Tang clan By HK Lawyer AJ Halkes Barrister-at-Law Hop up to Kam Tin if you have time for the once-in-a-decade...Read More

People just don’t care enough about bicycles in Hong Kong By HK Lawyer AJ Halkes Barrister-at-Law People just don’t care enough about bicycles. But they can be recycled by a...Read More