Why invest in Hong Kong food and beverage right now .. and perhaps why not .. Part 1 of 3

By HK Lawyer AJ Halkes Barrister-at-Law

I’ve seen people invest because they enjoy eating and drinking, loved a restaurant, wanted to back a chef to go solo, or got taken by a fancy spreadsheet, some just for the buzz.

All reasons to write a cheque; people buy sports cars, art and shares in private businesses as they enjoy what those businesses create; food, fashion, or something less sexy.

But f&b “investment” is a leap of faith on someone’s ability to turn passion into performance (plus profit) and a skill (often cooking in this case) into a sustainable business.

I’ve seen great success stories among my clients. Who can forget the dynamic chef & barman duo at Eclipse who took over an old run-down Chinese restaurant, morphing it into a lively Thai outlet with a cheap lick of paint, new table covers and a few photos. These “makeover” opportunities are around in Hong Kong, affordable leases, capex is low, and it’s been a great time to grab a site that’s fully equipped; this is when it is a good time to get in, but some of the best deals may have already gone to savvy operators.

That duo expanded the McSorley’s chain and built the iconic Coyote in Wan Chai. Scaling through energy, creativity, and relentless adaptability. If a concept didn’t succeed, they reworked it, changed tack and kept moving forward. They built a group with many shareholders. Some did well, others less so, depending on which outlets they backed. But most enjoyed being part of the business. They took pride in calling a restaurant their own and being part of something larger. The Igor’s group was similar in style and scaling as were a good few others.

That’s reason number one to invest in F&B. Find guys you like, be involved because you want to be, enjoy the people, the energy, the journey and the excitement of being part of something meaningful and dynamic.

An F&B investment offers far more satisfaction than betting on a horse at Happy Valley or watching a boring stock tick up and down each morning; people do get off on that I know, each to his own.

And remember, even a thriving, profitable F&B business is not a liquid one. It can be difficult to find a buyer if you want to sell your shares, so your return depends on ongoing profits rather than resale value, and in a few years or months, it won’t be the new hot go-to place. But more of that next.

In part 2, I’ll explore more of why you might not want to invest in a food and beverage business in Hong Kong and tell a couple of disaster tales.

If you need specific input regarding a strategic Hong Kong challenge or related legal matters in the HKSAR, you can always DM me and check out my profile at https://www.ajhalkes.com

hashtag#HongKongBusiness hashtag#FNBInvestment hashtag#RestaurantIndustry hashtag#FoodandBeverage hashtag#HospitalityInsights hashtag#BusinessStrategy hashtag#InvestInHongKong hashtag#HKEntrepreneurs hashtag#AsiaBusiness hashtag#HKBarsAndRestaurants

The government has imposed standards on protective netting around occupied residential properties By HK Lawyer AJ Halkes Barrister-at-Law The government has imposed standards on protective netting around occupied residential properties,...Read More

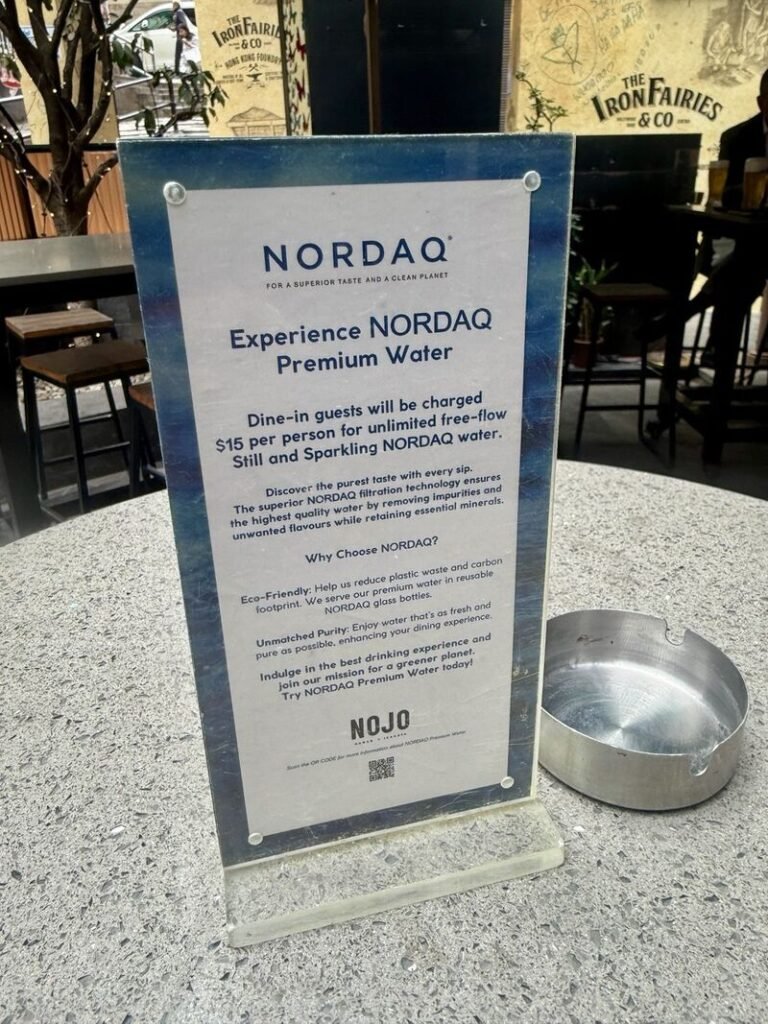

When water is basically free and all F&B outlets have a filtration system – why charge? By HK Lawyer AJ Halkes Barrister-at-Law When water is basically free, and all F&B...Read More

Suffering long term COVID effects is very real for some businesses By HK Lawyer AJ Halkes Barrister-at-Law Suffering long-term COVID effects is very real for some businesses. Even though the...Read More

Hire the right influencers, create the right buzz, now you can sell almost anything! By HK Lawyer AJ Halkes Barrister-at-Law I wrote about this place opening on a site that,...Read More

So Hong Kong is lucky, here comes Luckin Coffee By HK Lawyer AJ Halkes Barrister-at-Law So Hong Kong is lucky, here comes Luckin Coffee. Will they be all over the...Read More

Not near the mid-levels HK escalator, you’ll struggle running a business in HK (SoHo) By HK Lawyer AJ Halkes Barrister-at-Law If you’re not near the mid-levels Hong Kong escalator, you’ll...Read More

Adrian Halkes appointed to the eBRAM Panel of Mediators! By HK Lawyer AJ Halkes Barrister-at-Law Happy to share my appointment to the eBRAM Panel of Mediators, using its innovative, tech-driven...Read More

Geronimo in Lan Kwai Fong is closing By HK Lawyer AJ Halkes Barrister-at-Law Geronimo in Lan Kwai Fong is closing; a 13-year ago leap of faith and courage, when my...Read More

Hong Kong has many quirky food and coffee spots for tourists and locals By HK Lawyer AJ Halkes Barrister-at-Law Hong Kong has many quirky spots for tourists and locals. Upper...Read More

Early bird gets the bun at the Sing Fat bakery in Kam Tin By HK Lawyer AJ Halkes Barrister-at-Law EARLY BIRD GETS THE BUN at the Sing Fat Bakery in...Read More

Is now the best time in decades for Hong Kong F&B operators to buy their own premises? By HK Lawyer AJ Halkes Barrister-at-Law Is now the best time in decades...Read More

Bad reviews do not mean bad business By HK Lawyer AJ Halkes Barrister-at-Law Bad reviews do not mean bad business. Don’t let perfect be the enemy of good food and...Read More

AI already is “way better” than junior human lawyers in many areas By HK Lawyer AJ Halkes Barrister-at-Law This is the harsh truth: “You have law firms that are currently...Read More

Privacy matters a lot if you run bars, restaurants, fitness venues, shops and clubs. By HK Lawyer AJ Halkes Barrister-at-Law Privacy matters a lot if you run bars, restaurants, fitness...Read More

Once in a decade Jiao Festival organised by the indigenous Tang clan By HK Lawyer AJ Halkes Barrister-at-Law Hop up to Kam Tin if you have time for the once-in-a-decade...Read More

People just don’t care enough about bicycles in Hong Kong By HK Lawyer AJ Halkes Barrister-at-Law People just don’t care enough about bicycles. But they can be recycled by a...Read More