Is now the best time in decades for Hong Kong F&B operators to buy their own premises?

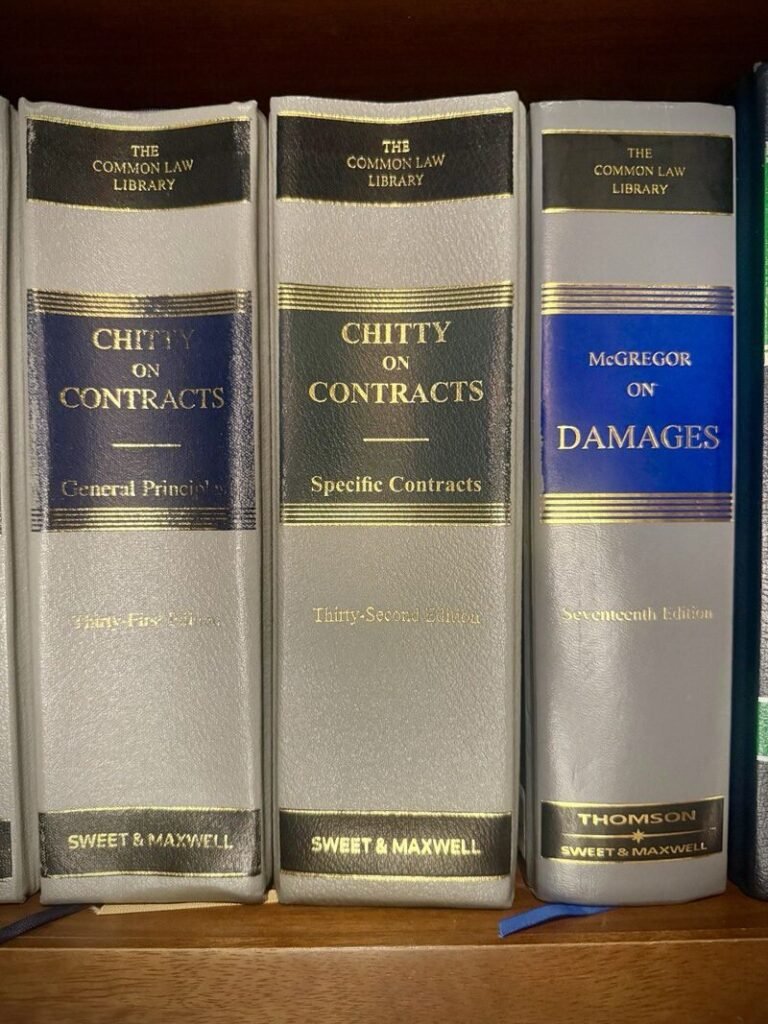

By HK Lawyer AJ Halkes Barrister-at-Law

Is now the best time in decades for Hong Kong F&B operators to buy their own premises? This means stability, freedom from rent increases and has made people rich before; so why not do it now?

For years, ground-floor retail or low-floor commercial space for F&B was very expensive and scarce; that’s no longer the case. Not since the early days of Lan Kwai Fong in the 90s and just before the Staunton and Elgin Street boom has commercial property looked this affordable relative to market potential.

The LKF group under Alan Zeeman combined F&B operations with owned real estate, and a handful of (now wealthy) bold entrepreneurs followed that path. Today, with older landlords cashing out, bank financing still tight, and sale prices depressed in specific pockets, buying your own shop makes very good sense.

The same logic applies to customer-facing businesses with personal clientele, such as vets, doctors, dentists, or long-term speciality retailers, who can lock in a location effectively now, forever, while prices remain low.

Central office rents are edging up for the first time in three and a half years, but there is still a window as Wyndham Street, and beyond, are filling up with new Korean restaurants, bakeries, and revived concepts are snapping up the remaining spaces; so perhaps it is even a bit too late?

Smart operators are always pouring millions into fit-out and rent that disappears forever, but could (should?) include a property deposit as part of the capital raise. Investors would own/receive a dual asset, the business upside combined with real estate, that now has fairly predictable long-term value.

It may be the best time in decades to follow in the footsteps of giants like Marks & Spencer, IKEA, and Hong Kong’s own billionaires, by owning the square feet beneath your business. Because even if your concept struggles, the real estate is unlikely to.

No time like today to stop renting your future and start owning it.

If you need specific input regarding a strategic Hong Kong challenge or related legal matters in the HKSAR, you can always DM me and check out my profile at https://www.ajhalkes.com

#HongKongRealEstate #FandB #CommercialProperty #LanKwaiFong #HongKongFNB #BuyDontRent #RetailInvestment hashtag#HongKongBusiness #Entrepreneurship #PropertyInvestment #LKF #AlanZeeman #FnBInvestment #BuyingRealEstate

The government has imposed standards on protective netting around occupied residential properties By HK Lawyer AJ Halkes Barrister-at-Law The government has imposed standards on protective netting around occupied residential properties,...Read More

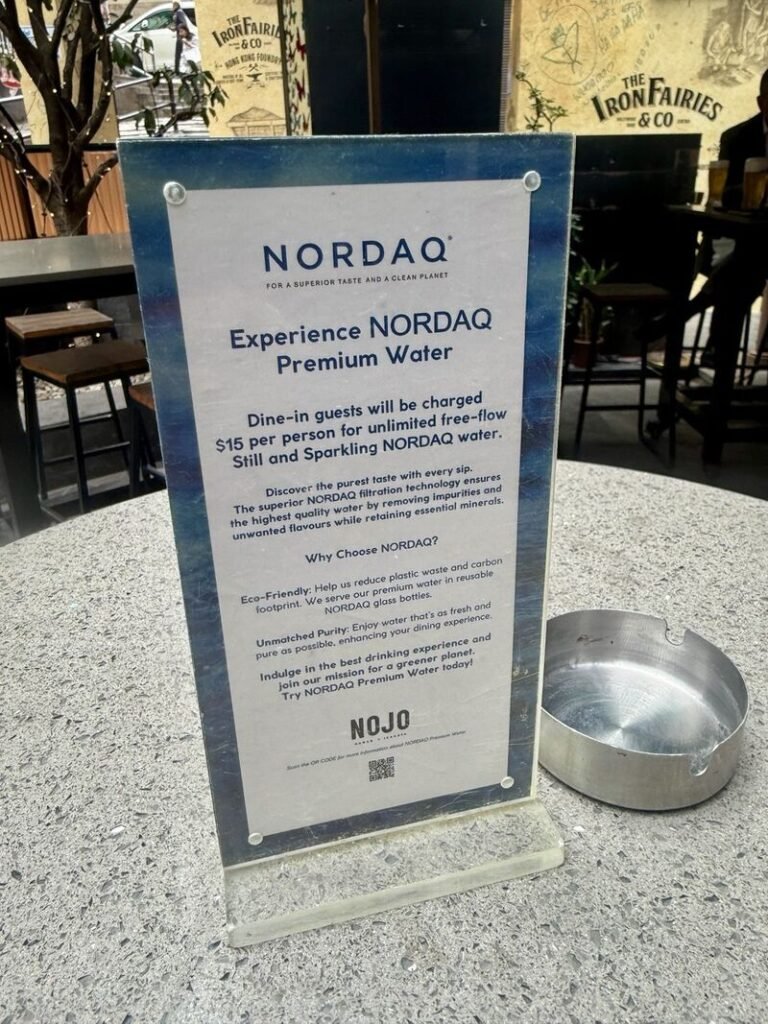

When water is basically free and all F&B outlets have a filtration system – why charge? By HK Lawyer AJ Halkes Barrister-at-Law When water is basically free, and all F&B...Read More

Suffering long term COVID effects is very real for some businesses By HK Lawyer AJ Halkes Barrister-at-Law Suffering long-term COVID effects is very real for some businesses. Even though the...Read More

Hire the right influencers, create the right buzz, now you can sell almost anything! By HK Lawyer AJ Halkes Barrister-at-Law I wrote about this place opening on a site that,...Read More

So Hong Kong is lucky, here comes Luckin Coffee By HK Lawyer AJ Halkes Barrister-at-Law So Hong Kong is lucky, here comes Luckin Coffee. Will they be all over the...Read More

Not near the mid-levels HK escalator, you’ll struggle running a business in HK (SoHo) By HK Lawyer AJ Halkes Barrister-at-Law If you’re not near the mid-levels Hong Kong escalator, you’ll...Read More

Adrian Halkes appointed to the eBRAM Panel of Mediators! By HK Lawyer AJ Halkes Barrister-at-Law Happy to share my appointment to the eBRAM Panel of Mediators, using its innovative, tech-driven...Read More

Geronimo in Lan Kwai Fong is closing By HK Lawyer AJ Halkes Barrister-at-Law Geronimo in Lan Kwai Fong is closing; a 13-year ago leap of faith and courage, when my...Read More

Hong Kong has many quirky food and coffee spots for tourists and locals By HK Lawyer AJ Halkes Barrister-at-Law Hong Kong has many quirky spots for tourists and locals. Upper...Read More

Early bird gets the bun at the Sing Fat bakery in Kam Tin By HK Lawyer AJ Halkes Barrister-at-Law EARLY BIRD GETS THE BUN at the Sing Fat Bakery in...Read More

Is now the best time in decades for Hong Kong F&B operators to buy their own premises? By HK Lawyer AJ Halkes Barrister-at-Law Is now the best time in decades...Read More

Bad reviews do not mean bad business By HK Lawyer AJ Halkes Barrister-at-Law Bad reviews do not mean bad business. Don’t let perfect be the enemy of good food and...Read More

AI already is “way better” than junior human lawyers in many areas By HK Lawyer AJ Halkes Barrister-at-Law This is the harsh truth: “You have law firms that are currently...Read More

Privacy matters a lot if you run bars, restaurants, fitness venues, shops and clubs. By HK Lawyer AJ Halkes Barrister-at-Law Privacy matters a lot if you run bars, restaurants, fitness...Read More

Once in a decade Jiao Festival organised by the indigenous Tang clan By HK Lawyer AJ Halkes Barrister-at-Law Hop up to Kam Tin if you have time for the once-in-a-decade...Read More

People just don’t care enough about bicycles in Hong Kong By HK Lawyer AJ Halkes Barrister-at-Law People just don’t care enough about bicycles. But they can be recycled by a...Read More